In order to meet the growing domestic demand for industrial ls, reduce external dependence and improve the ability of resource security, China has started a round of "going out" boom in the past decade. S & P global market intelligence (S & amp; P global market intelligence) has compiled a set of charts to show the overseas ambitions of China's mining industry from the perspective of foreign media.

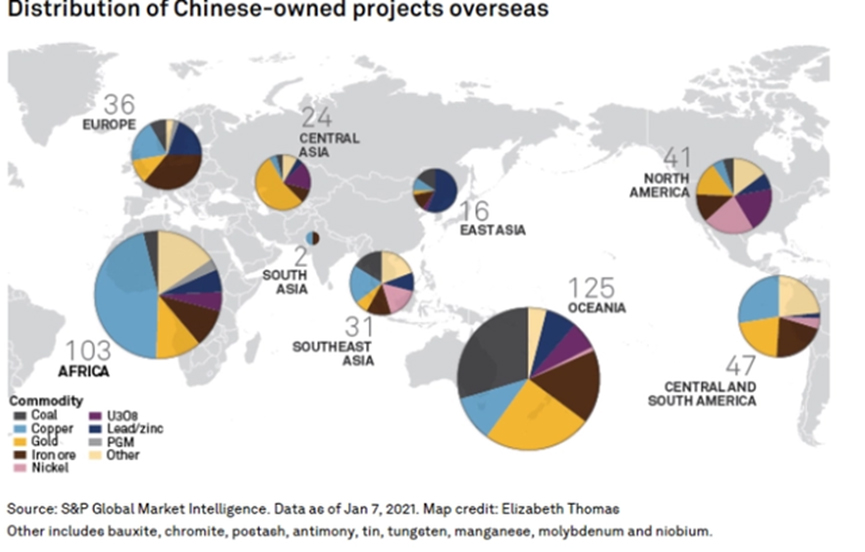

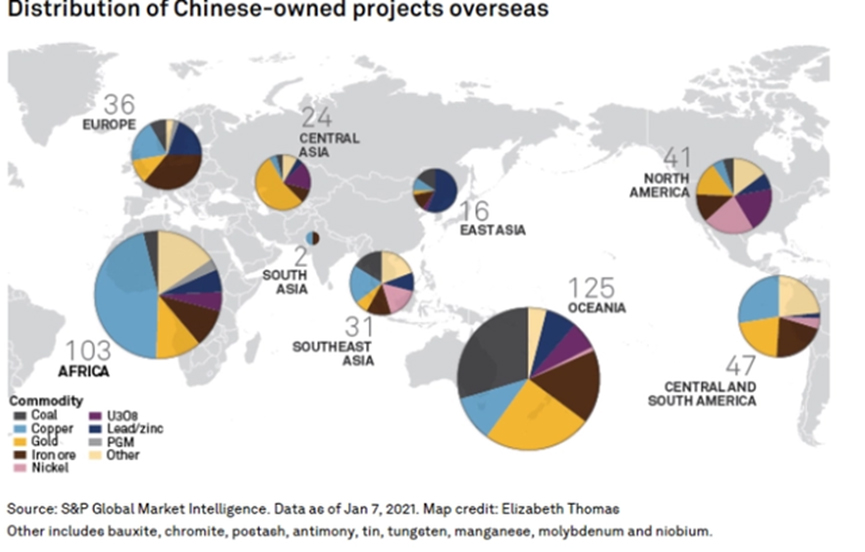

Figure distribution of China's overseas projects

1、 Australia and Africa become the gathering places of China's overseas resources

According to the global data of S & P, at present, Chinese enterprises have 425 overseas mining projects, mainly in Australia and Africa< Strong > China's projects in Australia are mainly coal, gold and iron mines Yanmei Australia owns and manages 11 coal mines including moraben, HVO and MTW, as well as 36.5% equity of Newcastle PWCS port and 27% equity of Newcastle Infrastructure Group (ncig) port. JORC has 7.924 billion tons of resources, 2.108 billion tons of reserves and 80 million tons of raw coal production capacity per year. It is the largest coal producer in Australia. Zijin Mining has 10.98 million ounces of gold resources and 860000 ounces of reserves in Australia's Norton gold field, which is a typical case of successful acquisition of large-scale overseas gold mines by Chinese enterprises. At present, Norton gold field is promoting the technical transformation and capacity expansion of low-grade gold and refractory gold. All of them have been completed, and can produce about 7 tons of gold in peak year. Hanwang holdings in China has also been rooted in Australia's gold mining industry for many years. Australia is rich in iron ore. Baowu group, Angang Group, CITIC and other domestic enterprises have iron ore projects in Australia, but the quality is poor, which is one of the main reasons why China's iron ore is controlled by others.

China's projects in Africa are mainly copper mines. In 2016, Luoyang molybdenum industry acquired tenke fungurume copper mine in Freeport with us $2.65 billion, and Zijin Mining and aifenhao mining are two "dazzling" representatives in the cooperative development of kamoa kakura copper mine project. Tenke fungurume copper cobalt mine has about 24.29 million tons of copper resources and 2.22 million tons of cobalt resources. It is the largest producer of copper and cobalt in Luoyang molybdenum industry. In 2020, the mine will achieve a net profit of 985 million yuan, accounting for 42.3% of the net profit of Luoyang molybdenum industry. The output of copper and cobalt is about 181600 tons and 15400 tons respectively, directly helping Luoyang molybdenum industry to become the world's second largest producer of cobalt and head copper. The kamoa kakula copper mine project of Zijin Mining has high expectations. On May 25, 2021, the first phase of copper concentrate production officially started, and on May 25, the copper concentrate production officially started.

2、 Copper, lithium and cobalt are the most popular

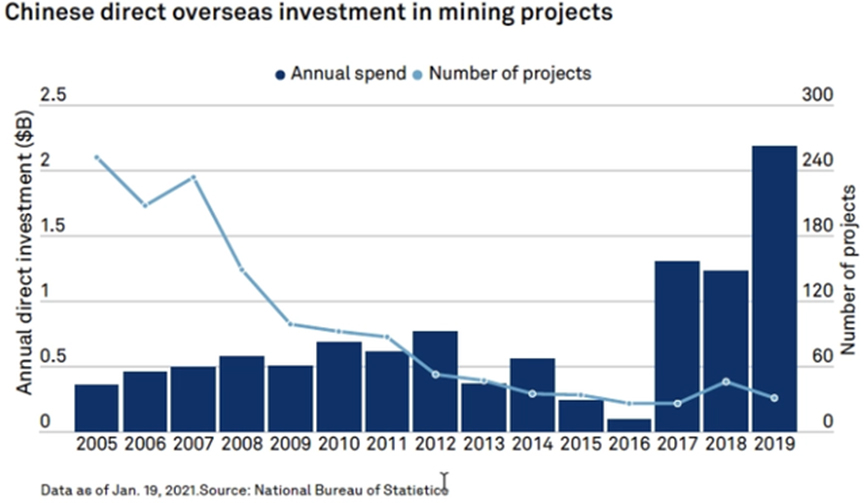

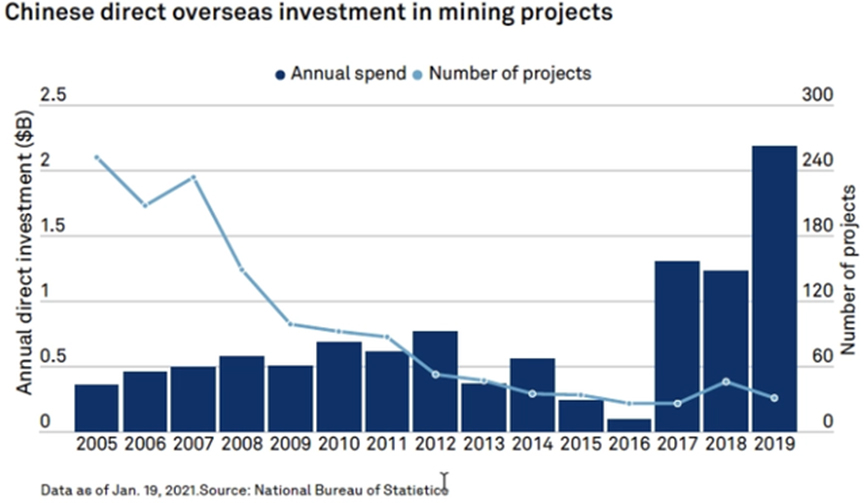

S & P global said that from 2011 to 2021, China's direct investment in overseas mines and projects reached US $16.1 billion. In terms of minerals, most of the funds were invested in copper assets. At present, Chinese enterprises have 30 copper projects in operation overseas, and another 38 are in the exploration stage.

In addition to copper, cobalt and lithium are the most popular targets in recent years. As the necessary ls for new energy batteries, lithium and cobalt are very popular in the market with the explosion of downstream demand. They are called "lithium grandfather" and "cobalt grandmother". In the near future, under the influence of the epidemic situation, overseas lithium mines may be in short supply, especially Africa, as one of the important lithium and cobalt production places, due to the impact of the epidemic situation, the recent shipment volume has greatly decreased. There is a great mismatch and differentiation in the structure of overseas lithium mines. Some enterprises with self-sufficiency may not lack "lithium cobalt", but some enterprises will face difficulties in purchasing lithium mines. If you have a mine at home, you can do whatever you want. At present, the prices of copper, iron ore, lithium, cobalt and other mineral products have risen sharply, and the pace of overseas mergers and acquisitions of domestic mining enterprises has slowed down. The overseas mines that were merged and put into operation before will usher in the situation of both quantity and price, usher in the harvest period, and also accumulate energy for the next round of mergers and acquisitions cycle.

Welcome to visit Dalian Shangfeng Flotation Reagents Co., Ltd. website!

Welcome to visit Dalian Shangfeng Flotation Reagents Co., Ltd. website! Service Hotline: 0411-84667000

Service Hotline: 0411-84667000

>

>